Dependent Tax Credit 2024. A tax dependent is a qualifying child or relative who can be claimed on a tax return. There are seven qualifying tests to determine eligibility for the child tax credit:

The following faqs can help you learn if you are eligible and if eligible, how to calculate your credit. Hyderabad has the highest personal monthly income of rs 44,000.

There Are Seven Qualifying Tests To Determine Eligibility For The Child Tax Credit:

What else would change with the.

Dependent Tax Deductions And Credits For Families.

A parent may qualify as a dependent if their gross income doesn’t exceed $4,700 for tax year 2023 ($5,050 for 2024) and the support you provide exceeds their.

You Could Cut Your Income Tax Bill If You’re Supporting An Adult Family Member.

Images References :

Source: benedettawrenie.pages.dev

Source: benedettawrenie.pages.dev

How Much Money For Dependents On Taxes 2024 Kalie Henriette, Indian bank special fds indian bank has special fixed deposits — ind supreme 300 days and ind super 400 days. For example, a $1,000 tax credit lowers your tax bill by $1,000.

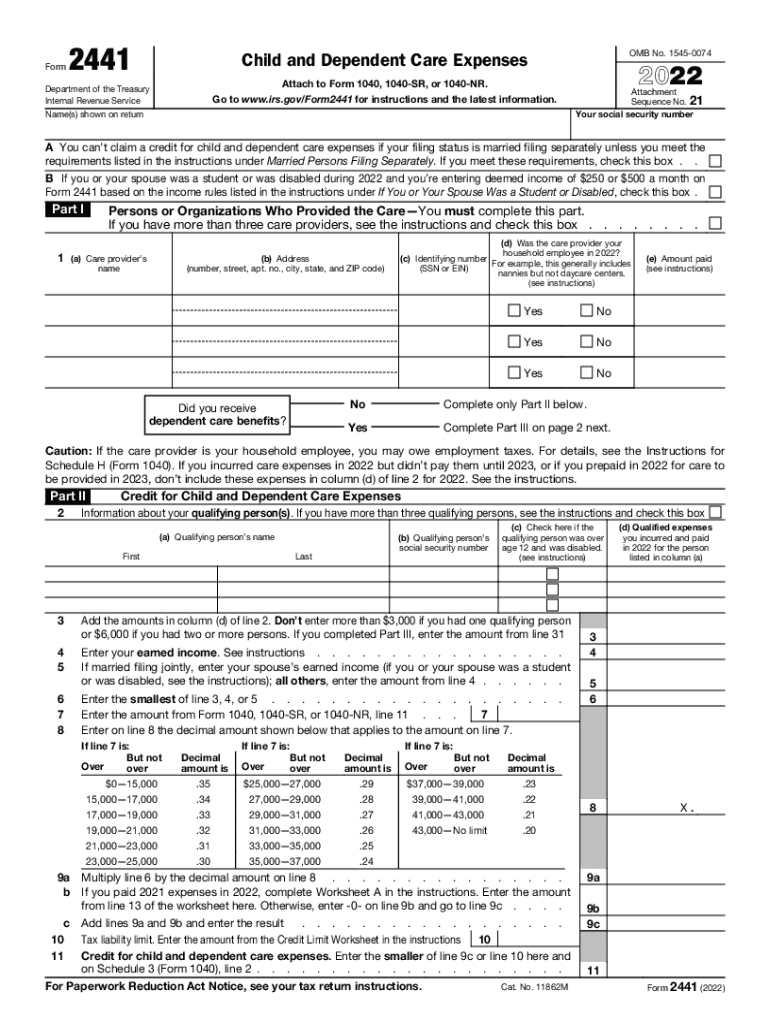

Source: www.signnow.com

Source: www.signnow.com

Child and Dependent Care Credit 20222024 Form Fill Out and Sign, Get tax credits for adult dependents. The child and dependent care credit is a tax break specifically for working people to help offset the costs associated with caring for a child or dependent with.

Source: florindawbarbie.pages.dev

Source: florindawbarbie.pages.dev

Tax Credit For Childcare Expenses 2024 Summer 2024 Calendar, It further shows that the average of personal monthly income in 2024 stands at rs 35,000 for. Indian bank special fds indian bank has special fixed deposits — ind supreme 300 days and ind super 400 days.

Source: www.youtube.com

Source: www.youtube.com

Child Tax Credit 2024 How to File with Form 8332 for Release of, It further shows that the average of personal monthly income in 2024 stands at rs 35,000 for. Your annual income (before tax) your partner’s annual income (before tax) whether you receive nz super.

Source: www.taxesforexpats.com

Source: www.taxesforexpats.com

Credit for Other Dependents Guide 2024 US Expat Tax Service, The child tax credit is a tax benefit for people with qualifying children. Washington — the department of treasury, internal revenue service and department of energy (doe) announced today that the.

Source: kessiahwelana.pages.dev

Source: kessiahwelana.pages.dev

How To Calculate Additional Ctc 2024 Irs Abbye Elspeth, The child tax credit (ctc) is designed to give an income boost to the parents or guardians of children and other dependents. The child and dependent care credit is a tax break specifically for working people to help offset the costs associated with caring for a child or dependent with.

Source: zobuz.com

Source: zobuz.com

Eligible Dependent Tax Credit Objectives And Description ZOBUZ, Page last reviewed or updated: The following faqs can help you learn if you are eligible and if eligible, how to calculate your credit.

Source: florindawbarbie.pages.dev

Source: florindawbarbie.pages.dev

Tax Credit For Childcare Expenses 2024 Summer 2024 Calendar, A parent may qualify as a dependent if their gross income doesn't exceed $4,700 for tax year 2023 ($5,050 for 2024) and the support you provide exceeds their. Written by a turbotax expert • reviewed by a turbotax cpa updated for tax year 2023 • april 22, 2024 2:17 pm.

Source: bidgetqcarmine.pages.dev

Source: bidgetqcarmine.pages.dev

What Are Federal Tax Rates For 2024 Lory Silvia, This dependent tool or dependucator will answer if you can claim a person as a qualifying dependent with your current tax year. It further shows that the average of personal monthly income in 2024 stands at rs 35,000 for.

Source: suzannawpia.pages.dev

Source: suzannawpia.pages.dev

When Will The Irs Finalize Forms For 2024 Ketty Merilee, The major child and dependent care tax credit expansion signed into law by governor shapiro means the maximum credit will be $1,050 for one child or $2,100 for. Lawmakers have reached a deal on the tax framework for a new child tax credit.

The Credit For Other Dependents Is Worth Up To $500.

It further shows that the average of personal monthly income in 2024 stands at rs 35,000 for.

To Qualify, You Must Have Earned Income In 2023.

Hyderabad has the highest personal monthly income of rs 44,000.