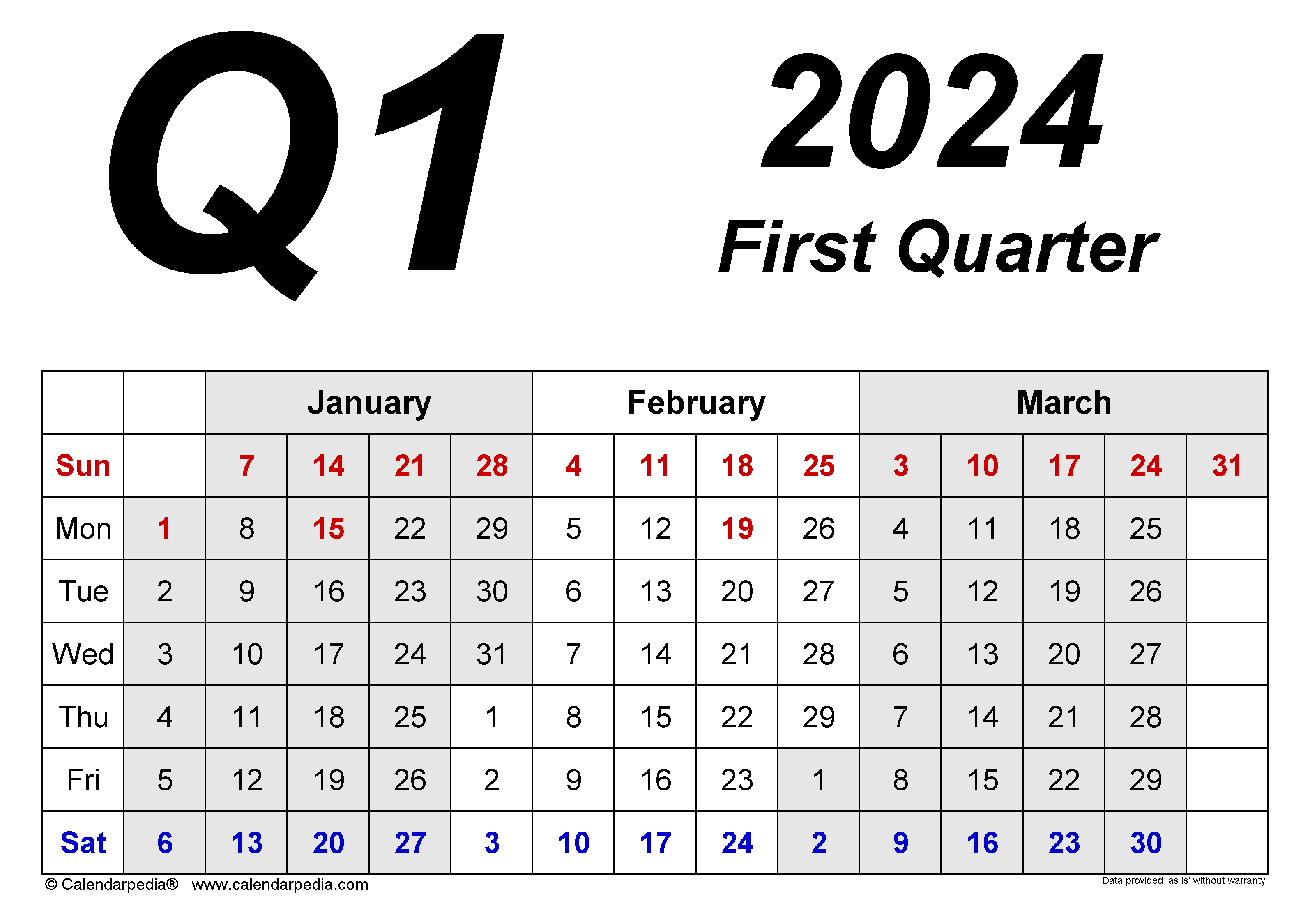

Quarter 1 Estimated Tax 2024. When are estimated taxes due? These payments are crucial for the.

Try keeper’s free quarterly tax calculator to easily calculate your estimated payment for both. These payments are crucial for the.

Thus, The 8 Percent Rate Also Applies To Estimated Tax Underpayments For The Second Calendar Quarter Beginning April 1, 2024.

When are estimated taxes due?

Estimated Quarterly Tax Payments Are Due Four Times Per.

View the amount you owe, your payment plan details, payment history, and any scheduled or pending payments.

The Estimated Tax Payment Deadlines For Individuals In 2024 Are As Follows:

Images References :

Source: gilliganwketti.pages.dev

Source: gilliganwketti.pages.dev

Quarter Tax Dates 2024 Rowe Liliane, April 1 to may 31: When are estimated taxes due?

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, Estimated quarterly taxes are due: When are the quarterly estimated tax payment deadlines for 2024?

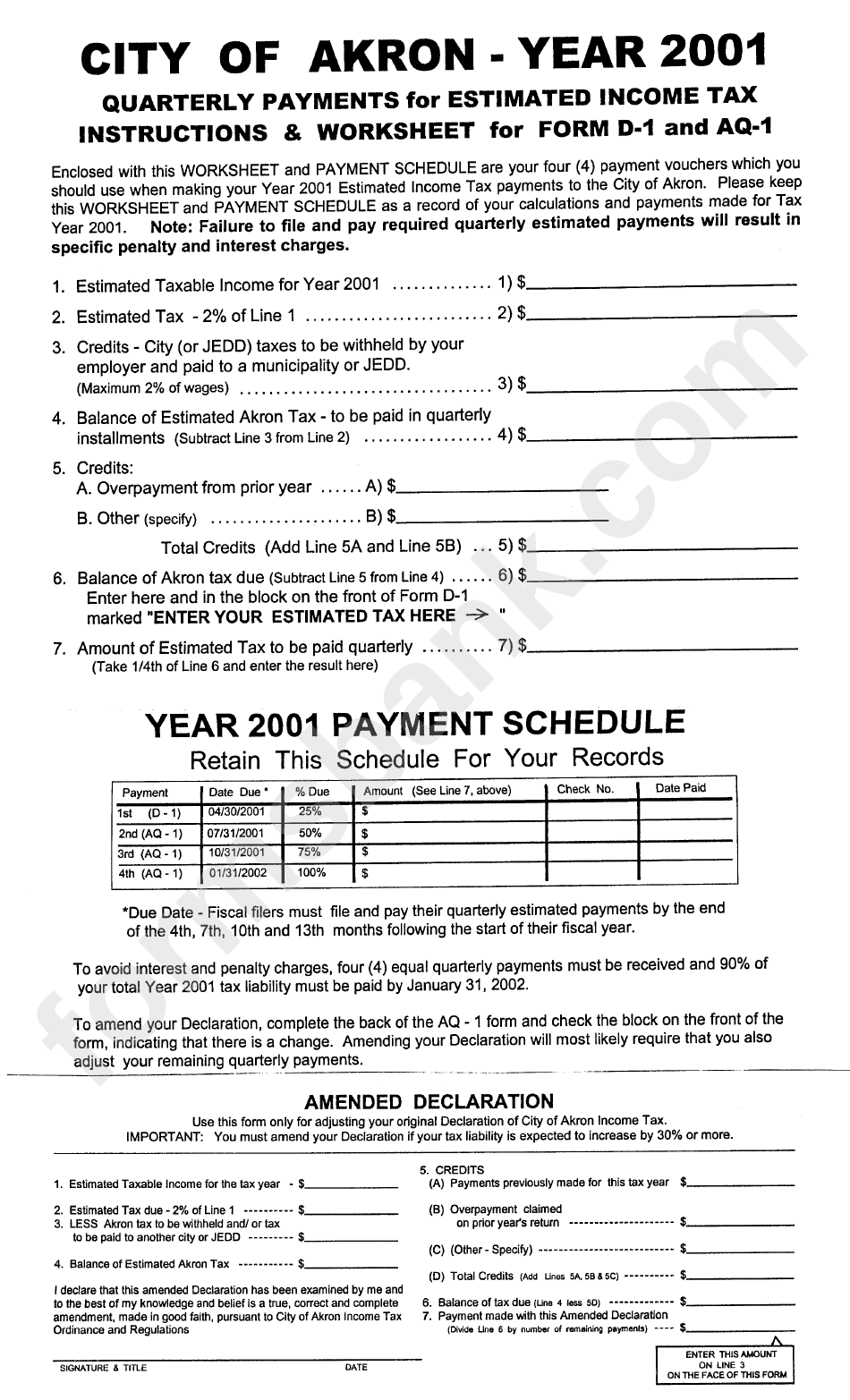

Source: www.formsbank.com

Source: www.formsbank.com

Quarterly Payments For Estimated Tax Form printable pdf download, 2024 due dates for estimated taxes; Estimated quarterly tax payments are due four times per.

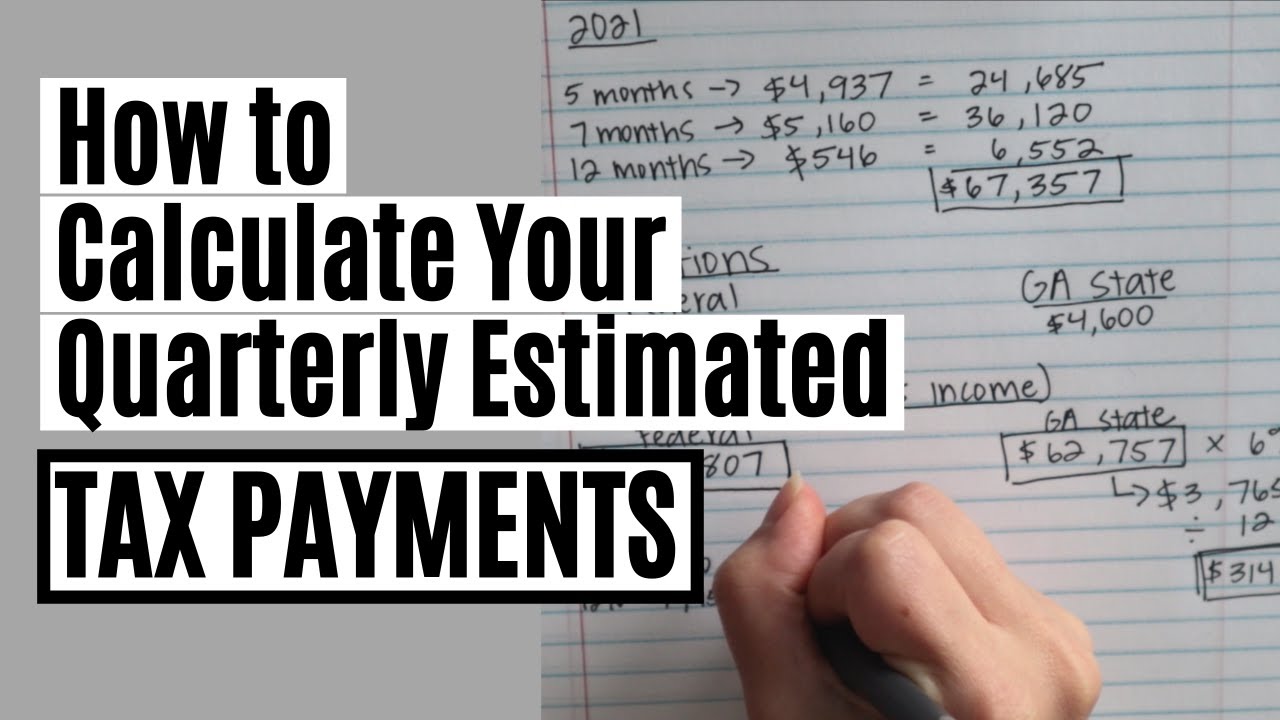

Source: www.youtube.com

Source: www.youtube.com

How to calculate estimated taxes 1040ES Explained! {Calculator, Try keeper's free quarterly tax calculator to easily calculate your estimated payment for both. When are estimated tax payments due in 2024?

Source: www.youtube.com

Source: www.youtube.com

How to Calculate Quarterly Estimated Tax Payments "UNEARNED", April 15,2024 is also the deadline for employees and retirees to make their first of four federal estimated tax payments for 2024. These payments are crucial for the.

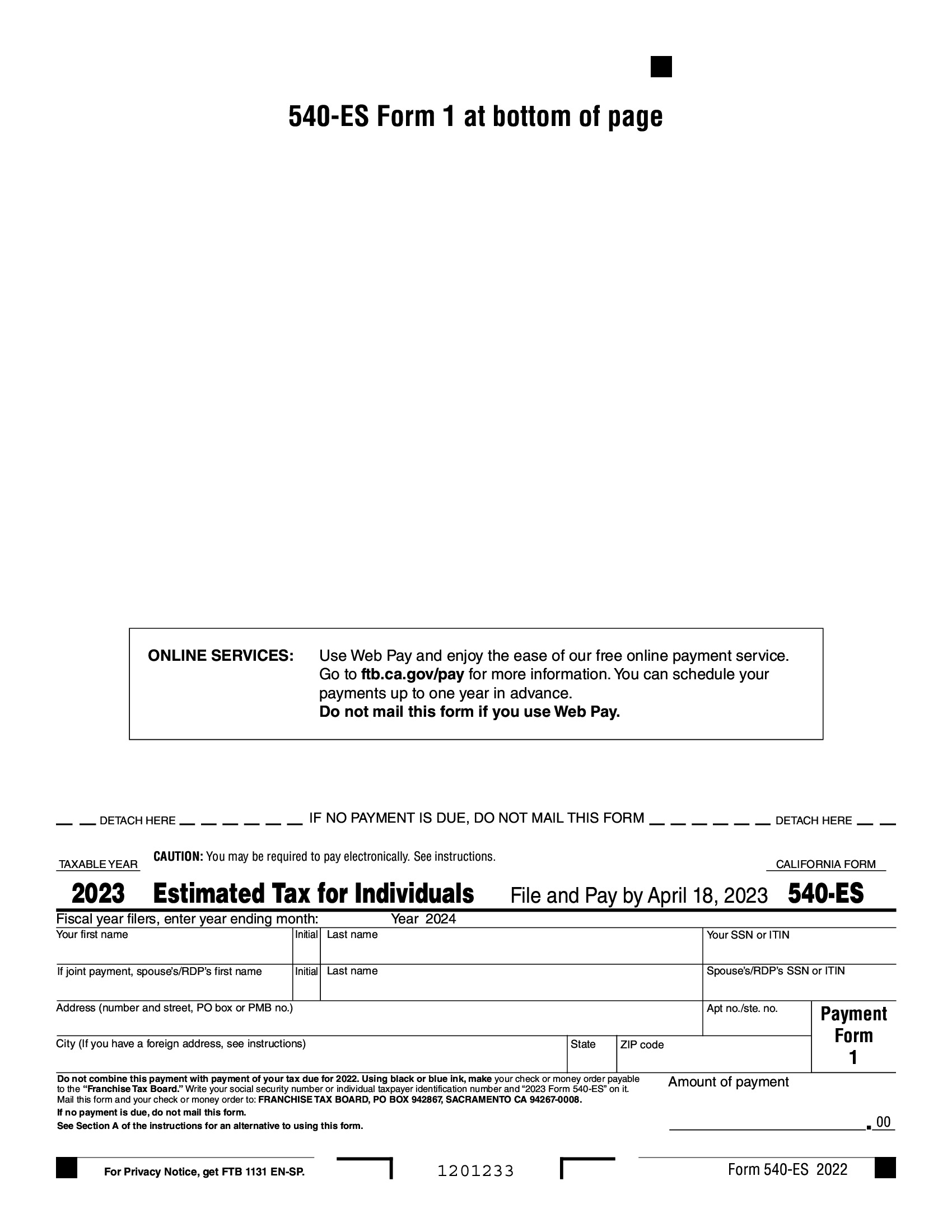

Source: blanker.org

Source: blanker.org

FTB Form 540ES. Estimated Tax for Individuals Forms Docs 2023, Learn how and when to make an estimated tax payment in 2024 — plus find out whether you need to worry about them in the first place. April 15,2024 is also the deadline for employees and retirees to make their first of four federal estimated tax payments for 2024.

Source: www.pinterest.com

Source: www.pinterest.com

Form 1040 ES, Estimated Tax for Individuals Internal Revenue Service, Here is an overview of the quarterly estimated tax payment deadlines for 2024: When are the quarterly estimated tax payment deadlines for 2024?

Source: www.youtube.com

Source: www.youtube.com

Learn How to Fill the Form 1040ES Estimated Tax for Individuals YouTube, First estimated tax payment due; When are the quarterly estimated tax payment deadlines for 2024?

Source: violettawfulvia.pages.dev

Source: violettawfulvia.pages.dev

Irs Estimated Tax Penalty Rate 2024 Doria, When are estimated tax payments due in 2024? Try keeper's free quarterly tax calculator to easily calculate your estimated payment for both.

Source: www.dochub.com

Source: www.dochub.com

Form pv maryland Fill out & sign online DocHub, These payments are crucial for the. If you don’t pay your estimated tax by january 16, you must file your 2023 return and pay all tax due by march 1, 2024, to avoid an estimated tax penalty.

Learn How And When To Make An Estimated Tax Payment In 2024 — Plus Find Out Whether You Need To Worry About Them In The First Place.

The 2024 quarterly estimated tax deadlines are:

Make A Same Day Payment From Your Bank.

Calculate your upcoming quarterly tax payment, with this free tool for freelancers.